Q1 2016 VentureDeal Quarterly Venture Capital Report

Alternative Energy -

Clean Tech - Energy - Environmental

During Q1 2016, a total of 26 companies received $542 million in

disclosed venture capital funding, representing a 13% decrease in the number of

companies funded and a 13% increase in total amounts funded vs. the previous quarter.

Alternative Energy

Alternative Energy companies, which include solar, biofuels, wind

power, hydrogen and other non-fossil fuel energy firms, continued to receive the

largest share of funding of the four industry sectors. 17 companies received $493

million in venture capital financing, which represented an 11% decrease in the number

of companies funded and a 44% increase in funding amounts versus the f3rd quarter

of 2015.

In the largest deal of the quarter,

Sunnova Energy

of Houston, Texas secured $300 million equity capital in a financing round funded

by private equity firm Energy Capital Partners. The company

is a solar service provider to residential markets nationwide and said it would

use the funding proceeds to accelerate its growth initiatives.

At the early stage, Owings Mills, Maryland-based

Differential Dynamics

raised $360,425 in equity financing, according to an SEC regulatory filing. The

company says that it is developing technologies to harness clean energy from the

power of rivers, using is “mechanical infinitely-variable motion-control devices.”

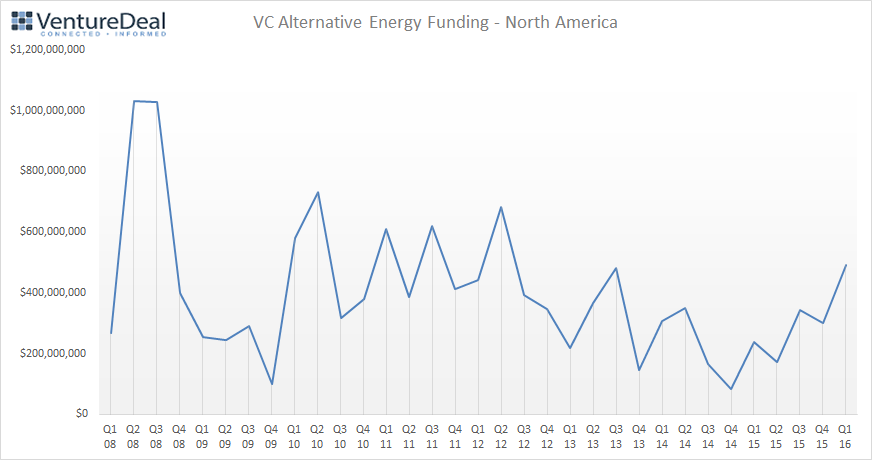

Alternative Energy Funding History - to 1st Quarter 2016

Clean Tech

Clean Technology deal volume continued its previous quarterly results

by decreasing to $23 million between 3 companies, a 63% decrease in aggregate funding

amounts and an 11% decrease in the number of companies funded versus the Q3 2015.

In the water treatment space,

Clearas Water Recovery received $4 million in Series B venture capital funding from

Next Frontier Capital and

Good Works Ventures.

The company has developed what it calls an Advanced Biological Nutrient Recovery

system that recovers excess nutrients from municipal wastewater operations and produces

no chemical by-products, reducing disposal fees.

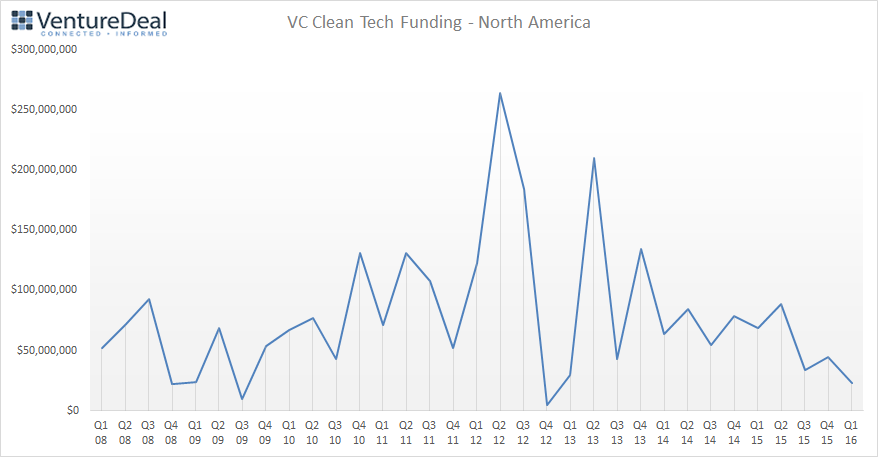

Clean Tech Funding History - to 1st Quarter 2016

Energy

Venture-backed Energy company fundings decreased by 53% to $26 million.

The number of companies funded tripled from 2 to 6 vs. Q3 2015.

Waltham, Massachusetts-based battery technology company

SolidEnergy secured $12 million in its Series B round

of strategic and venture capital investment. The company says that it has “revolutionized

portable energy storage with the introduction of the anode-free lithium metal battery.”

Corporate investors in the round were SAIC Venture Capital and Applied Ventures.

Gridtential landed $1.5 million out of a total offering of $2 million, according

to an SEC regulatory filing. The company is developing an advanced lead-acid battery

that it says will replace the metal grid in current lead-acid battery designs. Gridtential

previously received funding from The Roda Group, which

invested in a number of alternative energy, clean tech and software companies.

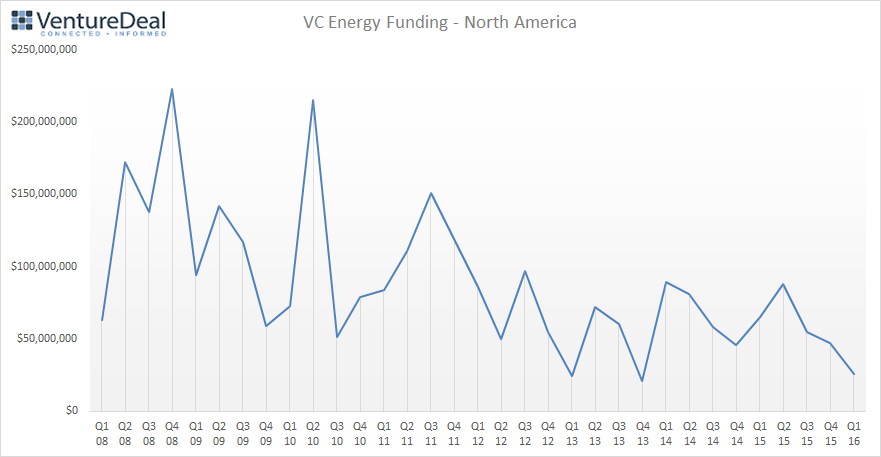

Energy Funding History - to 1st Quarter 2016

Environmental

There were no Environmental transactions during the quarter, continuing

the same low or nonexistent activity in the sector.

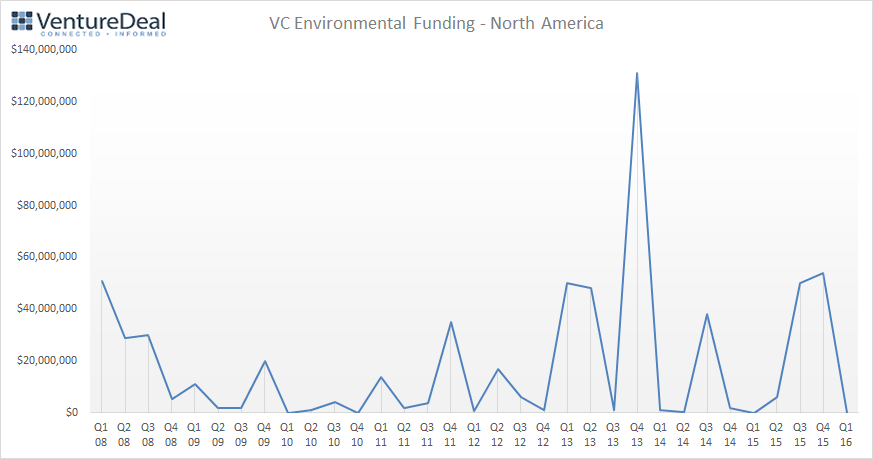

Environmental Funding History - to 1st Quarter 2016

Table 1

Venture Capital Funding - 1st Quarter 2016

|

Industry

|

Total

Disclosed Funding

|

% Change

Vs. Prior

Quarter

|

Number of

Companies Funded

|

% Change vs. Prior Quarter

|

|

Alternative Energy

|

$493 million

|

+ 44%

|

17

|

- 11%

|

|

Clean Technology

|

$23 million

|

- 32%

|

3

|

- 63%

|

|

Energy

|

$26 million

|

- 53%

|

6

|

+ 300%

|

|

Environmental

|

$--

|

--

|

0

|

--

|

|

Total

|

$542 million

|

+ 13%

|

26

|

- 13%

|

This material has been prepared and issued by VentureDeal. The information contained

herein is based on current information that VentureDeal considers reliable, but

we make no representation that it is accurate in the future or complete, and it

should not be relied upon as such. It is provided with the understanding that VentureDeal

is not acting in a fiduciary capacity.