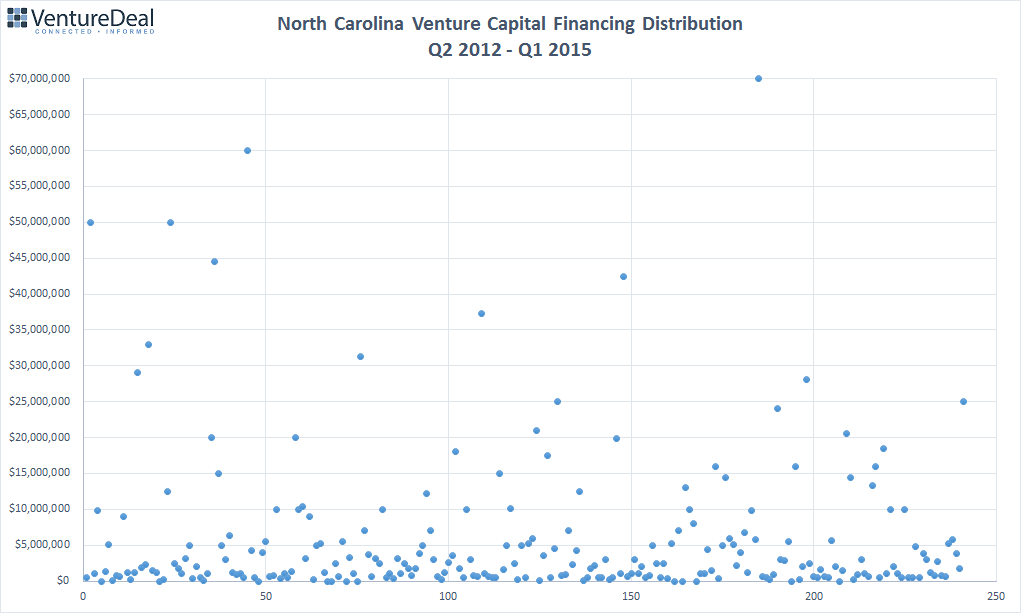

The distribution of financing amounts for technology startups based in North Carolina shows some interesting characteristics:

The vast majority of funding rounds over the three year period of Q2 2012 to Q1 2015 were for $5 million or less.

This could indicate a number of things. One, that venture funding in the state is largely focused on very early stage companies. If so, this bodes well for the developing "pipeline" of investable companies as they grow and mature.

Two, it could mean that the only investment stages that local venture capital firms and angel investors are focused on are early stage startups. If this is the case, this may present a problem as companies require additional investment to fully build out their services and take advantage of the available market opportunities.

In any case, the distribution does show larger rounds are being funded. A more detailed analysis of later stage funding indicates that it is skewed toward life science companies. Of the 26 investments of $15 million or more, 18 of the companies funded were life science companies - biotechnology, pharmaceutical or medical device firms. Only 8 companies were general technology firms.

While there's nothing wrong with that, in order to have a truly diverse technology base, the state would be well served by redoubling its efforts to promote the development of general technology industry companies.