Q3 2015 VentureDeal Quarterly Venture Capital Report

Alternative Energy - Clean Tech - Energy - Environmental

During Q3 2015, a total of 30 companies received $481 million in disclosed venture capital funding, representing a 3% increase in the number of companies funded and a 36% increase in total amounts funded.

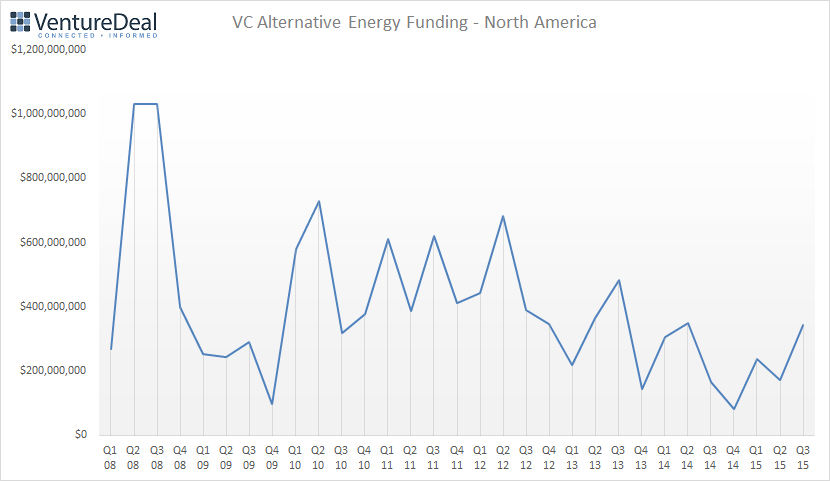

Alternative Energy

Alternative Energy companies, which include solar, biofuels, wind power, hydrogen and other non-fossil fuel energy firms, continued to receive the largest share of funding of the four industry sectors. 19 companies received $342 million in venture capital financing, which represented a 58% increase in the number of companies funded and a 100% increase in funding amounts versus the second quarter of 2015.

Enerkem secured $115 million equity capital in a financing round funded by Asset Management Ventures. The Montreal, Canada-based company has developed “a unique clean gasification and catalysis technology that converts waste into transportation fuels and chemicals.” Enerkem said it would use the funding proceeds for the product expansion of its Edmonton facility and its global growth initiatives.

San Francisco-based Advanced Microgrid Solutions raised $18 million in its Series A round from DBL Partners. The company installs advanced energy storage systems in buildings to help lower energy costs. AMS did not say how it would use the funding proceeds.

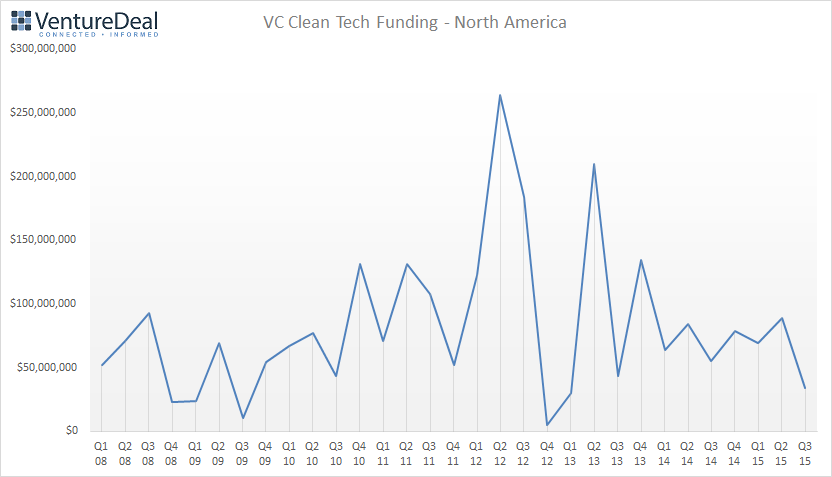

Clean Tech

Clean Technology deal volume reversed its previous quarterly results by decreasing to $34 million between 8 companies, a 62% decrease in aggregate funding amounts and an 11% decrease in the number of companies funded versus the previous quarter.

In the renewables space, Elevance Renewable Sciences received $10.3 million in venture capital debt from 5 undisclosed investors, according to an SEC regulatory filing. The company provides a range of specialty chemicals from natural oils using a process called olefin metathesis. Elevance did not say how it would use the funding proceeds.

Princeton, New Jersey-based Organica Water raised $9.1 million in funding from at least two investors. Organica has developed solutions for the treatment and recycling of wastewater in urban environments. XPV Water Partners led the round, although the company did not say how the funding proceeds would be used.

Energy

Venture-backed Energy company fundings decreased by 38% to $55 million. The number of companies funded decreased from 7 to 2, continuing a recent trend of decreasing activity.

Rechargeable energy storage company Enevate raised $30 million in equity investment from investors led by Infinite Potential Technologies. The company is developing improved battery capacity using today’s standard Li-ion technologies. Enevate said it would use the proceeds to bring its products into high-volume mass production and also expand into new applications such as powering drones.

Hayward, California-based Primus Power landed $25 million in its fourth round of institutional venture capital investment. I2BF led the round, which included other venture capital firms and strategic investors. The company provides grid-scale energy storage solutions with a scalable distributed system that it says economically serves a variety of stores applications such as transmission capacity, renewable energy integration and frequency regulation.

Environmental

There was one Environmental transaction during the quarter, the same as in the previous quarter.

Atlanta, Georgia-based Rubicon Global received $50 million in new investment from family office Nima Capital and other undisclosed investors. The company says that it “provides waste and recycling services that deliver sustainable solutions cost-reduction to businesses around the globe.”

Table 1 - Venture Capital Funding - 3rd Quarter 2015

| Industry |

Total

Disclosed Funding |

% Change

Vs. Prior

Quarter |

Number of

Companies Funded |

% Change vs. Prior Quarter |

Alternative Energy

|

$342 million |

+ 100% |

19 |

+ 58% |

Clean Technology

|

$34 million |

- 62% |

8 |

- 11% |

Energy

|

$55 million |

- 38% |

2 |

- 71% |

Environmental

|

$50 million |

-- |

1 |

-- |

| Total |

$481 million |

+ 36% |

30 |

+ 3% |

This material has been prepared and issued by VentureDeal. The information contained herein is based on current information that VentureDeal considers reliable, but we make no representation that it is accurate in the future or complete, and it should not be relied upon as such. It is provided with the understanding that VentureDeal is not acting in a fiduciary capacity.